I had asked the seller if there were any outstanding debts against the properties. She said no. "I own it outright."

We list the house and accept an offer.

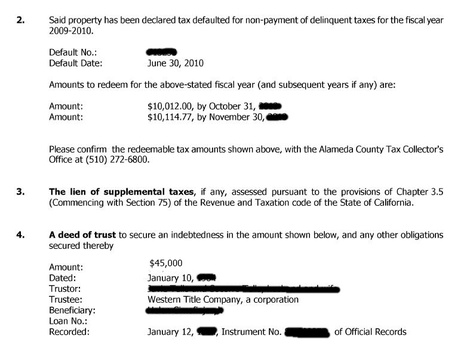

We got the preliminary title report* as usual. In a couple of days I get a call from the escrow agent. "What about the $45,000 personal loan on the prelim?" I react, "huh?" the escrow agent said, "We need a payoff demand. It looks like it's a personal loan. Can you get the contact information from the seller."

So I called the seller.

Me: "Do you know anything about this loan? It looks like it's 30 years old. It's owed to a man."

Seller: "That was a long time ago. Just tell them that debt no longer matters. Please."

Me: (Really?!) "That's not the way it works. The loan has to be paid off or the title company won't insure the property. The buying bank won't make the loan because banks don't lend on clouded titles. Do you know where the person is?

Seller: "No. He passed away a long time ago."

Me: "He's dead? Oh, no."

So I called the escrow agent.

Me: "Jamie, the person who made that loan has passed away."

Jamie: "You're gonna have to do a probate."

Me: " I knew you're were gonna say that."

Jamie: "I know a good probate lawyer."

Me: "Yeah, me too."

And that's how we ended up in a probate sale situation. Guess what? It''ll be a few months to resolve it. So the sale is cancelled. Oh, my.

Me: "What's this about defaulted property taxes? It says $10,114!"

Seller: "Really? I don't know anything about that."

* Preliminary Title Report: A report done by a title company before issuing title insurance coverage. The report shows the ownership of a specific property along with the liens and encumbrances that will be paid off and covered.

RSS Feed

RSS Feed